There are many options for web-based invoicing software. If you only generate a few invoices a year (2 or less a month) you could get by with Excel or Numbers. Remember to look out for specific features like multiple currencies or time tracking if you need them.

#EXCEL FREELANCE BOOKKEEPING SOFTWARE#

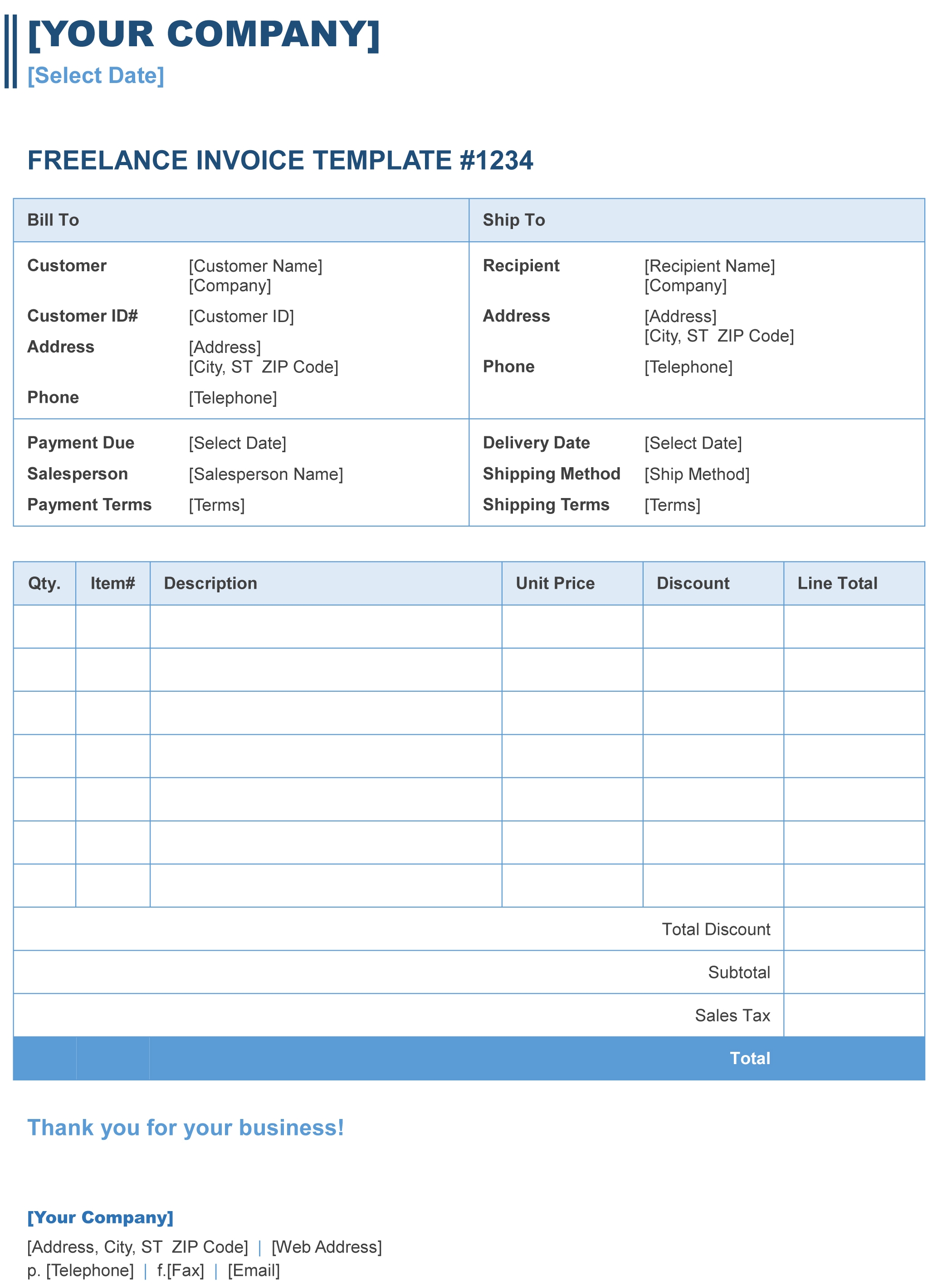

You can generate your invoices manually with a word processor or spreadsheet software, but it’s much better to use dedicated invoicing software because it can generate reports, track who’s late to pay you and more.

Upon completion of a project or at the end of the month, you send the client an invoice stating the amount owed by them for your products or services. This way you don’t need to run to the ATM to make a bank transfer every time you need to pay someone. If you are just freelancing on the side and feel that you can make do without writing cheques, you should at least open a savings account with online banking. If your business is more than a side job, go open a current account. Maybank’s basic current account also requires a minimum deposit of RM500. However most banks in Malaysia require that someone introduces (vouches) for you before you can open your current account. Ideally you should open a current account so that you can write cheques. Even if you haven’t formally registered your business, go open a separate account just for your freelancing business. Bank accountĭo not mix your business and personal bank accounts. Your bookkeeping will not magically fall into place without preparation. It will confuse you and make it an enormous chore to keep your books in order. If you’ve just started your business, I don’t think you need a full-on accounting solution like Quicken or MYOB. For most freelancers and sole proprietorships though, it is quite adequate. It’s important to stress that this isn’t really an accounting system – it’s more of a bookkeeping system.

This year, I handed my accountant my records a whole 5 weeks before the deadline, so she has plenty of time to compute my taxes. It’s almost the tax submission deadline (for businesses) again.

0 kommentar(er)

0 kommentar(er)